Ever dreamed of jetting off to a private island or cruising the Mediterranean on a superyacht? For ultra-high-net-worth families, that dream is often a reality. But managing luxury travel and lifestyle for the world’s wealthiest isn’t all champagne and caviar. As a family office professional, you’re tasked with creating unforgettable experiences while navigating a maze of logistics, security concerns, and sky-high expectations. Buckle up as we explore five game-changing trends reshaping luxury travel management for family offices. From AI-powered concierges to sustainable adventures, you’ll discover how to take your clients’ getaways from ordinary to extraordinary. Ready to level up your luxury travel game?

Trends Shaping Luxury Lifestyle and Travel for Family Offices

The world of luxury travel is evolving rapidly, with exciting new trends emerging to cater to the discerning tastes of ultra-high-net-worth individuals. As a family office manager, staying ahead of these trends is crucial to provide your clients with truly exceptional experiences. Let’s explore some of the most captivating developments shaping the luxury travel landscape.

Out of This World Experiences

Forget first-class flights – space tourism is the new frontier for luxury travel. Companies like Space Perspective are now offering six-hour journeys to the edge of space, giving your clients a truly otherworldly adventure. It’s the ultimate bucket list experience that sets a new standard for exclusivity.

Bespoke Adventures and Cultural Immersion

Today’s luxury travelers crave authenticity and personalization. They’re seeking immersive cultural experiences that go beyond the traditional cookie-cutter approach. Whether it’s encountering wildlife in Africa or exploring the pristine “White Desert” in Antarctica, the focus is on curating transformative, one-of-a-kind journeys that resonate on a personal level.

Sustainable Luxury and Wellness

Eco-conscious travel options that blend sustainability with high-end experiences are becoming increasingly popular. At the same time, wellness is taking center stage, with luxury retreats offering holistic programs tailored to individual health goals. It’s about indulgence with a purpose, allowing your clients to rejuvenate mind, body, and soul while minimizing their environmental impact.

Prioritizing Individual Needs in Family Wealth Management

In the evolving landscape of family wealth management, a one-size-fits-all approach no longer cuts it. You need to recognize that each family member has unique financial goals, risk tolerances, and values. High-performing family offices are now prioritizing individual needs alongside collective goals, ensuring that wealth strategies resonate with every generation.

Tailoring Solutions for Each Generation

Gone are the days of blanket investment strategies. Today, it’s about crafting personalized financial roadmaps. Younger generations often have a higher appetite for risk and a more growth-oriented investment strategy, with keen interest in emerging asset classes like cryptocurrencies and sustainable investments. By contrast, older family members might prioritize wealth preservation and legacy planning.

Bridging the Generation Gap

To keep the family wealth intact, you need to foster open communication across generations. Consider establishing a family venture fund to encourage entrepreneurship or using investments as a bridge to engage younger members. This approach not only aligns with their values but also prepares them for future wealth management responsibilities.

Leveraging Technology for Personalization

Embrace the power of AI and data analytics to deliver hyper-personalized strategies. Morgan Stanley’s report suggests that family offices should invest in robust data sources and consolidated reporting platforms to stay ahead of market trends and maximize investment capabilities. This tech-forward approach allows you to tailor solutions that cater to each family member’s unique financial fingerprint.

Leveraging the DuPont Model for Optimizing Family Office Finances

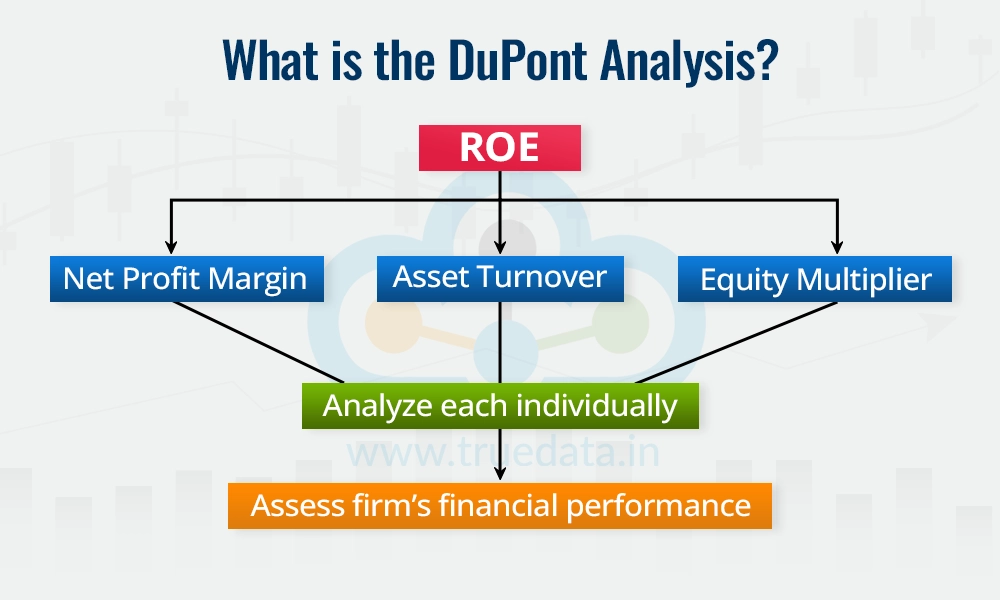

In the realm of luxury lifestyle and travel management, family offices are increasingly turning to sophisticated financial models to maximize their returns. One such powerful tool is the DuPont Model, which can help you dissect and optimize your financial performance.

Breaking Down ROE

The DuPont Model breaks down Return on Equity (ROE) into three key components: profit margin, asset turnover, and equity multiplier. By understanding these elements, you can identify specific areas for improvement in your family office’s financial strategy.

Tailoring Strategies for Growth

Your family office can leverage this model to make informed decisions about financial leverage and asset utilization. For instance, if you’re managing a portfolio with stable income streams, you might consider taking on more debt to amplify returns. Conversely, for riskier investments, a more conservative approach might be prudent.

AI-Powered Analysis

In today’s tech-driven world, you can supercharge your DuPont analysis with AI tools. These “co-pilots” can help you generate detailed financial reports, identify trends, and even suggest optimization strategies tailored to your family’s unique financial landscape.

By mastering the DuPont Model and coupling it with cutting-edge AI analysis, you’ll be well-equipped to navigate the complex world of luxury travel and lifestyle management, ensuring your family office’s financial success for generations to come.

The Rise of Wealth Management AI “Co-Pilots”

In the ever-evolving landscape of luxury travel and lifestyle management, a new trend is taking flight: AI “co-pilots” for wealth management. You might be wondering, what exactly are these digital sidekicks, and how are they revolutionizing the way family offices operate?

Enhancing Efficiency and Insights

AI co-pilots are emerging as powerful allies for wealth managers, handling tasks like identifying investment opportunities, spotting data issues, and managing compliance. By processing vast amounts of information at lightning speed, these AI assistants free up your advisors to focus on what really matters – building relationships and crafting personalized strategies for your family’s wealth.

Personalized Service at Scale

Imagine having a virtual assistant that knows your family’s financial goals inside and out. AI-powered tools are enabling wealth managers to provide more tailored advice and services, even as they juggle an increasing number of clients. From automating routine tasks to offering data-driven insights, these co-pilots are helping family offices deliver a truly bespoke experience.

Navigating the AI Revolution

While the potential of AI in wealth management is enormous, it’s not without challenges. Concerns about data privacy, regulatory compliance, and the balance between human expertise and machine intelligence are all part of the conversation. As you consider embracing this trend, it’s crucial to partner with firms that prioritize both innovation and trust.

Mastering Luxury Travel Management for Family Wealth

In the world of high-net-worth individuals, luxury travel management is more than just booking first-class flights and five-star hotels. It’s about creating unforgettable experiences that align with your family’s values and aspirations. Let’s dive into how you can elevate your travel management game.

Balancing Independence and Guidance

You might feel the urge to plan everything yourself, but don’t underestimate the value of expert guidance. With increasing price pressures in the luxury market, having a knowledgeable advisor can help you navigate the best deals without compromising on quality. They can unlock exclusive experiences that you might not even know exist.

Personalizing the Experience

Remember, it’s not just about the “we” but also the “me.” High-performing family offices understand the importance of catering to individual preferences within the family unit. Whether it’s arranging a private cooking class for the foodie in your family or securing tickets to a sold-out event for the sports enthusiast, personalization is key.

Leveraging Technology

Embrace the power of AI “co-pilots” in wealth management. These tools can help you make data-driven decisions about your travel investments, ensuring that every trip aligns with your overall wealth strategy. From predicting travel trends to optimizing your loyalty program benefits, technology can give you a significant edge in luxury travel management.

By mastering these aspects, you’ll not only enhance your family’s travel experiences but also contribute to your overall wealth management strategy. After all, in the world of luxury, every decision counts.

Conclusion

As you can see, luxury travel management is evolving rapidly for ultra-high-net-worth families. From personalized experiences to sustainable adventures, the bar keeps rising. But with the right strategies, you can stay ahead of the curve. Remember to leverage tech, prioritize privacy, and tap into exclusive networks. Most importantly, focus on creating meaningful memories and bonding opportunities for your clients’ families. After all, that’s what truly matters in the end. So go forth and plan those once-in-a-lifetime trips with confidence. Your clients are counting on you to deliver unforgettable luxury experiences that go beyond their wildest dreams.